Female founders in the US are outperforming in 2021, with one quarter to go

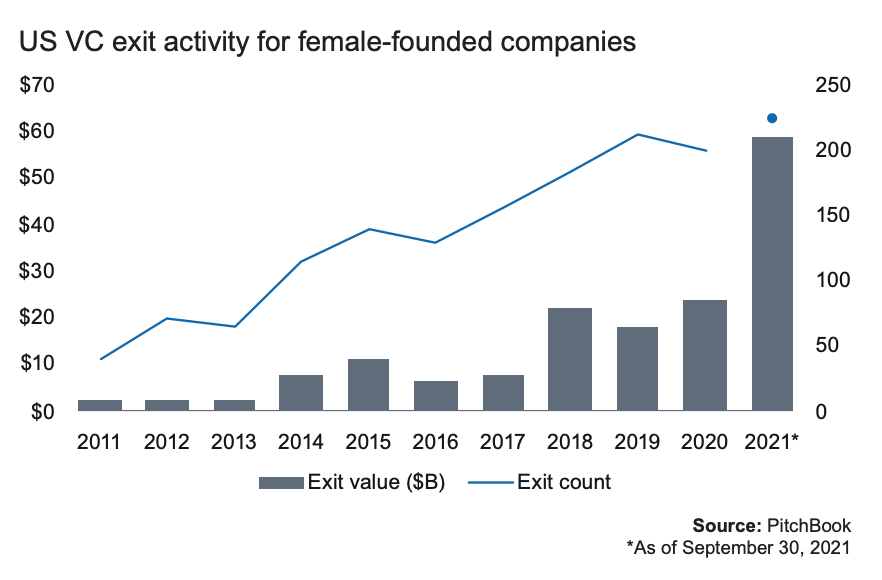

In spite of unprecedented challenges brought on by the pandemic, female founders in the US are outperforming in 2021. Female-founded companies (VC-backed companies with at least one female founder) have overdelivered despite receiving a fraction (~2%) of venture capital funding. All in: Women in the VC Ecosystem by Pitchbook shows that in the first three quarters of 2021, female founders exited and sold off almost $59 billion, which is already a record, with one quarter left in 2021. US VC exit count is also breaking records, well ahead of last year and on track to surpass 2019.

The pandemic’s impacts are real, and in terms of pay parity and labor participation, we’ve seen progress set back by decades. While the venture market wasn’t entirely crushed, there was a difference in how female-founded and male-founded companies fared. In 2020, “[v]enture dollars invested in female-founded companies fell by 3.0%, while deal count fell by 2.2%. In other words, the pie was bigger, but female founders received a smaller slice.”

As we look to rebuild, numbers around female entrepreneurship and funding are encouraging and offer a glimpse into new behaviors and models prompted by the focus on recovery. In the last year, we’ve seen more female founders raise money with female funders: “in 2017… about 20% of female angel investments went to female founders. Today, almost a third of them do, and the ratio continues to grow.”

Pitchbook shared: “the number of women in institutional check-writing roles has a significant ripple effect in the industry.” We see more women in decisionmaking and checkwriting roles and that trend means more and bigger companies (and exits) with women at the helm. From 2020 to 2021, the proportion of female angel investors grew, in hubs like Silicon Valley (increased from 15.4% to 17.1%), New York City (increased from 11.8% to 16.8%), Boston (major life sciences focus; increased from 13.6% to 14.5%), and Los Angeles (increased from 12.1% to 12.9%). The potential long-term effects from these increases, in addition to the record-smashing success of female-founded companies this year, are incredibly powerful in helping to shift the balance in terms of funding, equity and power.

Featured in the report are Ann Miura-Ko, Co-Founding Partner of Floodgate Ventures, and Shiza Shahid, Co-Founder and Co-CEO, Our Place, and Co-Founder, Malala Fund, sharing their thoughts on what it means when more women are in control of the checkbook:

I see diversity in the boardroom, in management, and on the cap table all in the same way. In Silicon Valley, we’re always looking for a network effect in our businesses. It’s what creates self-sustaining and exponential growth. When you access talent—just as when you access customers or revenue growth—you also want a network effect. When your talent base is diverse and empowered to express themselves, you not only minimize your potential blind spots, but you expand your access to great talent anywhere. I see diversity and inclusion as a competitive edge you can use if you have the proper commitment.

– Ann Miura-Ko, Co-Founding Partner of Floodgate Ventures

We need more women in control of capital. We need to teach them how to invest, get hired and promoted at VC firms, and start their own funds. We also need to help them access circles that give them exposure to quality investments. The cost of not addressing equity is not just a morally unjust world, but one where we are not recognizing our collective potential.

– Shiza Shahid, Co-Founder and Co-CEO, Our Place, and Co-Founder, Malala Fund

Download the full report here, and let us know how this impacts your career [and angel investing] plans.

Join the MBAchic community to connect with and create opportunities for one another. We’re just getting started.